UK food and drink manufacturing records fastest growth for fourth consecutive month

November 25

10:00

2024

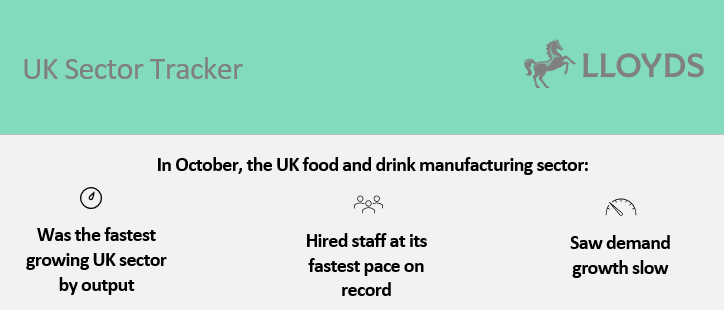

The latest Lloyds UK Sector Tracker reveals that in October, food and drink manufacturers recorded the fastest output growth of all sectors for the fourth consecutive month (65.3 vs. 66.1 in September). The Tracker, which uses exclusive PMI data to track the performance of 14 sectors of the UK economy, also revealed this was despite slower demand growth (53.6 vs. 66.5 in September). Businesses were surveyed between 10 and 29 October.

Food and drink producers saw input costs rise at the slowest rate (55.0) since March 2024. As a result, they also slowed the rate at which they raised prices charged to customers (50.5 vs. 58.4), which includes supermarkets and retailers. Firms in the sector also hired staff at their fastest pace on record (59.7 in October vs. 50.7 in September), since January 1998 when the Tracker began.

A reading on the Tracker above 50.0 indicates expansion, while a reading below 50.0 indicates contraction.

Aled Patchett, Head of Consumer at Lloyds, said: “This month’s Tracker reflects the determined optimism of the businesses that we speak to in the sector, as we head into one of the busiest times of the year.

“Branding and positioning are more important than ever as consumers think more actively about the composition of their food and drink spend, and they are increasingly looking for nutrition and convenience. Businesses are also keeping a close eye on the possible impact on supply chains caused by recent global weather impacts. The sector sees some challenges ahead, but businesses continue to work hard to navigate their way through them.”

The broader UK picture

Looking at activity across all 14 sectors, October’s Tracker shows that six sectors saw output rise month-on-month, one more than in September. Five sectors saw demand, as measured by new orders, rise, which remains unchanged from the previous month. Overall, 12 sectors saw their input costs rise, two fewer than in September. The same number (12) also raised their prices charged to customers, which remains unchanged from September.

Nikesh Sawjani, Senior UK Economist at Lloyds, said: “While the number of sectors reporting higher output increased in October, the data suggests that growth in recent months has become focused on fewer sectors compared to the first half of the year. In part, this has been driven by some softening in demand conditions – with the number of sectors reporting increases in new orders also moderating in recent months – but also likely reflects some firms facing capacity limits due to lower employment levels.”

THE DATA

Sector performance charts

The following charts show output and demand recorded across all 14 sectors over the last two years.

|

Chart 1: Activity remains strong

|

|

Chart 2: Demand growth slows

|

|

|

|

|

|

Source: Lloyds UK Sector Tracker, S&P Global

|

Source: Lloyds UK Sector Tracker, S&P Global

|

Output and demand recorded in October for each of the 14 sectors

Output growth: Food and drink manufacturing (65.3), software services (61.1), financial services (56.2), real estate (55.0), healthcare (53.4) and technology equipment manufacturing (51.6).

Output contraction: Automobile and auto parts manufacturing (49.0), chemicals manufacturing (48.8), industrial goods manufacturing (48.2), professional services (48.1), tourism and recreation (47.9), household products manufacturing (47.6), transportation (45.8) and metals and mining (43.0).

Growing demand, as measured by new orders: Software services (65.7), real estate (57.6), financial services (54.5), food and drink (53.6) and industrial goods manufacturing (51.3)

Contracting demand, as measured by new orders: Tourism and recreation (49.9), commercial and professional services (49.4), household products manufacturing (47.4), metals and mining (46.7), chemicals manufacturing (46.4), technology equipment manufacturing (46.3), healthcare (43.6), transportation (43.5) and automobile and auto parts manufacturing (35.0).

The Lloyds UK Sector Tracker includes indices compiled from responses to S&P Global’s UK manufacturing and services PMI® survey panels, covering around 1,300 private sector companies.

The Lloyds UK Sector Tracker monitors the following 14 individual UK sectors: Chemicals, Metals & Mining, Automobile & Auto Parts, Beverages & Food, Household Products, Industrial Goods, Technology Equipment, Tourism & Recreation, Financial Services (this sector has been updated to include banks, insurance providers and other financial services firms), Commercial & Professional Services, Transportation, Software & Services, Healthcare and Real Estate.