The Knowledge Development Box-What you need to know

The Knowledge Development Box (KDB) was introduced by Finance Act 2015 for companies whose accounting period commences on or after 1st of January 2016 and is an important element in the Road Map for Ireland’s Tax Competitiveness. In relation to the KDB, it is a regime for the taxation of income which arises from patents, copyrighted software and, in relation to smaller companies, other intellectual property (IP) that is similar to an invention which could be patented. The Irish system was the first Knowledge Box or Patent Box in the world to meet the Organisation for Economic Co-operation and Development (OECD) ‘modified nexus’ standard, with the UK following in April of this year. With the modified nexus approach, the KDB is directly related to the qualifying expenditure associated with the R&D and in Ireland’s case the R&D Tax credit regime. In brief, a company which qualifies for the KDB will be entitled to a deduction equal to 50% of its qualifying profits in computing the profits of its specified trade. In effect, the profits arising from patents, copyrighted software or IP equivalent to a patentable invention are taxed at 6.25% rather than the headline rate of 12.5%. The modified nexus approach requires that the income from intellectual property that can be taxed at the preferential rate of 6.25%, is limited by the proportion of income arising from R&D activities. The calculation used is presented in Figure 1.

The Knowledge Development Box (KDB) was introduced by Finance Act 2015 for companies whose accounting period commences on or after 1st of January 2016 and is an important element in the Road Map for Ireland’s Tax Competitiveness. In relation to the KDB, it is a regime for the taxation of income which arises from patents, copyrighted software and, in relation to smaller companies, other intellectual property (IP) that is similar to an invention which could be patented. The Irish system was the first Knowledge Box or Patent Box in the world to meet the Organisation for Economic Co-operation and Development (OECD) ‘modified nexus’ standard, with the UK following in April of this year. With the modified nexus approach, the KDB is directly related to the qualifying expenditure associated with the R&D and in Ireland’s case the R&D Tax credit regime. In brief, a company which qualifies for the KDB will be entitled to a deduction equal to 50% of its qualifying profits in computing the profits of its specified trade. In effect, the profits arising from patents, copyrighted software or IP equivalent to a patentable invention are taxed at 6.25% rather than the headline rate of 12.5%. The modified nexus approach requires that the income from intellectual property that can be taxed at the preferential rate of 6.25%, is limited by the proportion of income arising from R&D activities. The calculation used is presented in Figure 1.

Figure1 Modified Nexus formula used to calculate the KDB.

The OECD recognises the necessary importance of R&D and the fundamental scale that investment in innovation can bring. This is also reflected in the Irish Governments Action Plan for Jobs 2015, whereby “The objective is to achieve best in class in the EU by enhancing support for firms, drive commercialisation through Enterprise Ireland (EI) / Knowledge Transfer Ireland (KTI) and introduce a Knowledge Development Box to ensure the tax environment is optimised for innovative enterprises located here.” One of the key enablers to driving R&D is a well-designed, competitive and sustainable tax policy to support the activity. As competition between countries to attract business expenditure on R&D and to develop technology intensive industries is growing. For Ireland, to compete and excel (particularly in a Base Erosion and Profit Shifting (BEPS) environment), it is important to be coherent and decisive about the actual innovative activities carried out by the multinationals and Irish owned companies alike.

As part of the Government’s strategy for meeting R&D targets under the Europe 2020 strategy, Ireland is aiming to invest 2.5% of GDP in R&D by 2020. In reference to the recent CSO analysis, results from the 2013 – 2014 Business Expenditure on Research and Development survey show that in excess of €2bn was spent on R&D activities by enterprises in Ireland in 2013, with €2.1bn estimated for 2014.

There are a number of reasons why a government may introduce a patent box, three of which are presented as follows: (i) to efficiently increase revenue by differentiating tax rates on more mobile income streams; (ii) to attract (or retain) inward investments that may be associated with high-skilled labour and knowledge creation; (iii) to incentivise companies to invest or increase investment in innovative activities.

In recent years, the introduction of dedicated Tax policies to promote innovation is now widely perceived as the key driver for economic growth and productivity. Intangible assets constitute a major input and value driver for multinational companies. Studies have shown that European firms’ intangible assets are more likely to be held in low-tax subsidiaries than tangible assets and that the location of patents is responsive to corporate income tax. Indeed, the value of a patent, the relative attractiveness of a location and a firm’s strategies and organisational structures are likely to vary across industries and, within industries, across firms.

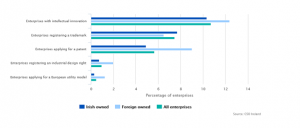

According to a recent study by the CSO (Innovation in Irish Enterprises, 2012-2014), 11% of enterprises had an intellectual innovation, with 8% registering a trademark and 6% applying for a patent. During the reference period, 7% of foreign owned firms licensed in from another enterprise, university or research institute compared to 2% of Irish firms, see Figure 1.

Figure 1 Intellectual property rights by nationality of ownership (2012-2014)

Both firm size and industry have been highlighted as important in the decision making of a company on how to organise their offshore activities. In relation to determining the location of the actual R&D, high quality infrastructure and an educated labour force have been documented as important deciding factors. In parallel, tax incentives such as generous rules surrounding the deductibility and creditability of expenditures, can also affect the location of R&D activity. However, companies operating in certain markets or using specific technologies might react differently, because, transfer pricing rules may be easier to circumvent for companies operating in markets where a high share of transactions are intra-firm; meaning it is difficult for tax authorities to accurately assess what is a fair market price. With this in mind, the OECD Action Plan on Base Erosion and Profit Shifting (BEPS) identifies preferential tax regimes such as IP Box regimes as a ‘key pressure area’ in tax policy and calls for measures to counter harmful tax practices more effectively.

Let’s look at a simplified example, take an Irish tax resident company in a global group of companies was engaged in R&D activities in partnership with an American partner group company in relation to the development of a new product in 2014 and 2015. The Irish company incurred €15 million in qualify expenditure and incurred outsourced expenditure to the American partner group company in the amount of €6 million, which represented the cost of the R&D activities to the American partner. Resulting in a total of €21 million in overall expenditure incurred to develop the IP asset.

The R&D activities were successful and the invention was awarded a 20 year patent in late 2015 and commercial sales of the product began in early 2016. Sales related to the qualifying asset (patent) in the year ended 31 December 2016 were €7m with related costs of €3m. Under the proposed regime the following amount of income would benefit from the 6.25% rate:

€

I.P. related income 7,000,000

I.P. related expenditure (3,000,000)

Qualifying profits 4,000,000

The income allowable for the 6.25% rate is then calculated as follows:

(€15m + €4.5m*) X €4m = €3.7m

€21m

This €3.7m is then reduced by 50 % (taken as a deduction) and taxed at 12.5% resulting in an effective rate of 6.25% and a liability of €231,250 as opposed to €462,500.

The uplift expenditure is calculated as the lower of 30% of the qualifying expenditure

(€15m x 30% = €4.5m*) or the acquisition costs + the group outsourcing costs (€6m)

Choosing your R&D and KDB advisors is an important decision for you. It is essential that your advisors have the skills and experience required to deal and grow with the financial and technical needs of your business. It is equally important to know that your dedicated advisors will be able to form and maintain an excellent working relationship with your team and conduct their work in a professional and flexible manor. Within Mazars, we have a proven track record with the key credentials to provide a first-class detailed and tailored service that will go beyond our client’s expectations. It is this commitment which has our clients returning year on year. We have a specific dedicated Research & Development Tax Group which focuses on assisting companies in identifying activities that qualify for the KDB and Research & Development Tax Credit. In addition, we have the significant in house scientific experience to assist and advice in both the claim and technology. Our service also extends to support our clients in the event of an audit. For more information please contact Dr James Kennedy at jkennedy@mazars.ie

Authors

Dr. James Kennedy, Manager – Research & Development Tax Credit Group, Mazars

James O’Hagan, Tax Consultant- Tax Credit Group, Mazars

Gerry Vahey, Partner- Tax Credit Group, Mazars