January Sees “Near-Record” Rise in Construction Employment

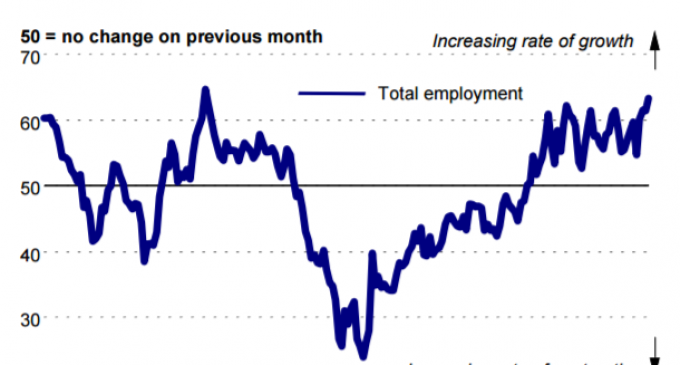

Activity in the Irish construction sector rose sharply in January on the back of higher new orders, according to the Ulster Bank Construction PMI Report, released on Monday. The survey highlighted a near-record rise in employment as companies responded to greater workloads.

The rate of input cost inflation quickened to the sharpest since February 2007 according top the same report. The Ulster Bank Construction Purchasing Managers’ Index (PMI) is a seasonally adjusted index designed to track changes in total construction activity – posted 55.7 in January, down from 58.9 in the previous month, showing a slower pace of expansion for the third month running.

“Irish construction activity continues to grow at a healthy pace,” Chief Economist Republic of Ireland at Ulster Bank, Simon Barry, said. “The headline PMI index remained comfortably in expansion territory in January, albeit that the pace of growth eased for the third month running consistent with a modest loss of momentum early in 2017 after a robust end to last year. Very encouragingly, Residential activity remains a particular bright spot with Housing activity continuing to rise at a rapid pace, while Commercial activity also very much remains in expansion mode, though the pace of growth has eased in recent months. Civil Engineering continues to lag behind the other sectors, with respondents reporting a third consecutive monthly decline in activity.

“Respondents continue to judge the Irish construction outlook to be very favourable. Confidence about future activity prospects remained strongly positive in January amid further solid gains in New Orders, despite some easing in the rate of increase. Indeed, buoyed by the ongoing increase in work volumes, last month saw a substantial and accelerated rise in staffing levels with the rate of job creation picking up to its second-fastest in the survey’s 16 ½ year history. One note of caution stems from further evidence of building cost pressures with the rate of input cost inflation picking up to its quickest in almost 10 years. Respondents reported higher prices for oil-related products and for items sourced from UK suppliers, the latter effect consistent with growing signs of Brexit-related price and costs increases in the UK economy.”

The rise in total activity reflected continued growth in both the commercial and housing sectors, though a stronger rise was recorded at the start of the year on housing projects. At the same time, Civil engineering activity continued to fall for the third month in a row.

New orders rose at a sharp, but reduced pace in January, according to the report. New business was reportedly linked to improving client demand amid stronger confidence.

Rising workloads drove a further increase in employment with the rate of job creation the second-fastest in the survey’s history, just behind November 2004. Approximately 27% of respondents indicated that there was a rise in staffing levels during the month.

Companies also increased their purchasing activity sharply in January, reflecting higher new orders. This was in spite of the rate of growth slowing from December to the slowest since June. Increased demand for inputs contributed to another lengthening of suppliers’ delivery times, although the rate of deterioration in vendor performance was recorded as the weakest in four months.

Further evidence of mounting cost pressures in the sector became apparent during January, with the rate of input cost inflation accelerating to the fastest since February 2007. According to respondents, higher prices for oil-related products and rising costs for items from UK suppliers were behind the latest increase.

Construction firms remained strongly optimistic that activity would increase over the coming year, with close to 60% of panellists forecasting an expansion. Positive sentiment was linked to confidence in the wider Irish economy and predictions of new order growth.

The full report can be read here.