February Cost Burdens Rise at Fastest Rate Since May 2011

The rate of input cost inflation accelerated sharply in February, amid higher prices for a range of raw materials, but output charge inflation moderated, according to the Investec Manufacturing PMI report for Ireland, released on Wednesday.

The report found that, overall, business conditions continued to improve in the Irish manufacturing sector during February as new orders rose sharply again, however, rates of expansion in output and employment eased from the start of the year.

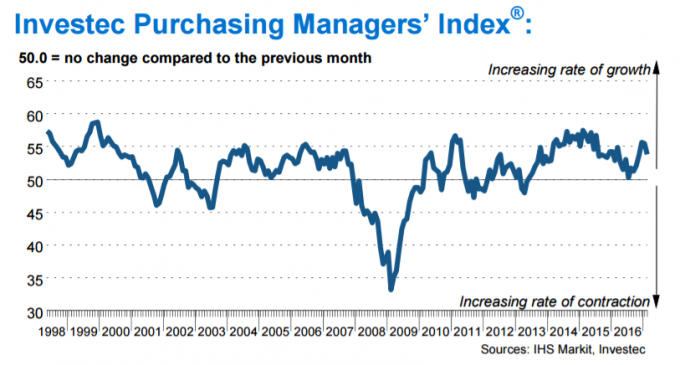

The seasonally adjusted Investec Purchasing Managers’ Index (PMI) dipped to 53.8 in February, down from 55.5 in January. The reading signalled a further solid monthly improvement in business conditions, albeit the weakest since last October when the current sequence of strengthening operating conditions began.

The main highlight from the latest survey was continued sharp growth of new business. New orders rose for the seventh month running and at a pace that was much stronger than the series average. New export orders also increased markedly, and to a greater extent than in the previous month.

Higher new orders fed through to production growth in February. Although the latest rise in output was solid, it was the weakest since October 2016. Growth of new business was also linked to a fifth successive monthly rise in backlogs of work, albeit one that was only slight.

Firms partly used inventories to help meet orders, while efforts to limit stock holdings also contributed to a marked reduction in post-production inventories.

Rising production requirements and confidence in the near-term outlook led manufacturers to increase their staffing levels again in February. That said, as with output the rise in employment was the slowest in four months. Confidence among manufacturers regarding the prospects for production growth picked up in the latest month. Reasons for optimism included expectations of improvements in economic conditions and rising new orders.

Input prices increased at a much faster pace in February, with the latest rise in cost burdens the steepest since May 2011. Respondents noted higher prices for a range of raw materials including steel, plastics and resin. While the rate of cost inflation accelerated sharply, output prices rose at a weaker pace than at the start of the year. Manufacturers expanded their purchasing activity for the sixth month running. The rate of growth was marked and slightly faster than seen in January.

Higher demand for inputs resulted in greater capacity pressure on suppliers and a subsequent lengthening of delivery times. That said, the latest deterioration in vendor performance was the weakest in nine months.

Increased input buying failed to prevent a further reduction in stocks of purchases as inputs were used in the production process. Moreover, the pace of reduction accelerated to a seven-month high.

“Manufacturing firms reported a softening in growth in Backlogs of Work for a third successive month, with only a slight increase recorded in February,” Investec Ireland Chief Economist Philip O’Sullivan said. “The current five-month sequence of increasing outstanding business is the longest since the series began in September 2002. We suspect that the recent sharp growth in hiring in the sector (the Employment component recorded a fifthsuccessive above-50 reading) is the main factor behind this moderation.

“However, given the continued uncertainty in the external environment, we are unsurprised to see Irish manufacturers retaining an air of caution, as evidenced by a marked depletion (at the joint-sharpest pace since April 2012) in Stocks of Finished Goods. Some firms said that they had implemented a deliberate policy of limiting inventories. In this regard, we note that Stocks of Purchases also fell, in this case for a tenth successive month, in February.

“On the margin side, Output Prices rose again in February as manufacturers passed on higher input costs to clients. The main Input Cost pressures being encountered at this time relate to raw materials such as steel, plastics and resin. More than 11 times as many firms recorded an increase in Input Costs compared to the number who reported a decrease. Given this pressure, it is not a surprise to see that Profitability decreased for the second survey period in a row, with competitive pressures and the strength of the euro against sterling also contributing to the fall in earnings.

“Despite the uncertainty alluded to above, Irish manufacturers remain upbeat on the outlook, with more than 15 times as many firms expecting to see output maintained or increased over the coming 12 months as against those who anticipate a decrease. All told, while this report shows that manufacturers are currently under pressure from a number of sources, it is also clear that most firms expect to be able to overcome this and record further growth over the coming year.”

The full report can be read here.