Eurozone Economy Expands at Fastest Rate in 67 Months

The end of 2016 saw the eurozone economy expand at the fastest pace since May 2011, according to the Markit Eurozone Composite Purchasing Managers’ Index, released on Wednesday. However, price pressures continued to mount, with inflation of both input costs and output charges gathering pace.

At 54.4 in December, up from November’s 53.9, the final Markit Eurozone PMI Composite Output Index signalled a faster rate of expansion than the earlier flash estimate. Manufacturing led the growth acceleration, with production increasing at the quickest pace since April 2014. Service sector activity also rose solidly, with the rate of increase staying close to November’s 11-month high.

Economic expansions were signalled across the ‘big-four’ nations. The fastest growth was seen in Spain (six-month high) followed closely by Germany (five-month high). The pace of increase in France accelerated to a one-and-a-half year record, but remained below the euro area average. Italy was the only one among the largest nations to see slower growth.

Underpinning the stronger expansion of eurozone economic activity was an improved inflow of new business. Growth of incoming new orders was the fastest since December 2015 and among the quickest seen over the past five-and-a-half years.

Solid increases were registered across the ‘big-four’ nations, led by Germany (although Germany was the only economy where growth did not accelerate).

Work-in-hand rose for the nineteenth month running in December, with the rate of increase equalling November’s record for that sequence. This in turn encouraged further job creation, with employment rising for the twenty-sixth month in a row.

Spain and Germany both registered solid jobs growth in December. France and Italy also saw employment increase, albeit marginally. Spain was the only one of the ‘big-four’ to see staffing levels rise at a faster pace than in November.

Input cost inflation surged to a five-and-a-half year record in December. This reflected a combination of higher fuel and oil prices alongside increased import costs due to the weaker euro exchange rate (the latter impacting manufacturers to a greater extent than service providers).

Output charges rose for the second month running and at the steepest pace since July 2011. Increases in Germany and Spain offset further price discounting in France and Italy.

Services

December saw further solid growth of eurozone service sector business activity. At 53.7, the final Markit Eurozone PMI Services Business Activity Index was down only slightly from November’s 11-month high of 53.8 and above the earlier flash estimate of 53.1. The fastest rates of expansion were signalled in Spain and Germany, despite both seeing output growth moderate slightly since the prior survey month. The pace of increase also eased in Italy. France was the only one of the ‘big-four’ to buck the slower growth trend, with business activity rising to the greatest extent since September. Although this took France above Italy in the output growth rankings, it remained below Germany and Spain. Data for Ireland are released on January 5th.

Eurozone service providers linked higher levels of business activity to a combination of solid inflows of new orders and rising backlogs of work. New business expanded at an identical pace to November’s ten-month high. Similar rates of increase were seen across the ‘big-four’ nations.

Backlogs of work rose for the seventh successive month. Companies responded by raising capacity, leading to an increase in employment for the twenty-sixth consecutive month. Staffing levels rose solidly in Germany and Spain, while an increase was also signalled in Italy. French services employment was unchanged.

Business confidence† hit an 11-month peak and was among the highest levels achieved over the past five years. Sentiment improved in Germany, France and Italy, but eased slightly in Spain.

December signalled that input cost inflation accelerated to a 57-month record, mainly due to higher fuel and oil prices. Marked and accelerated cost increases were signalled across the ‘big-four’ nations.

Output charges rose for the second month running and to the greatest extent since July 2011.

Increases in Germany and Spain offset reductions in France and Italy.

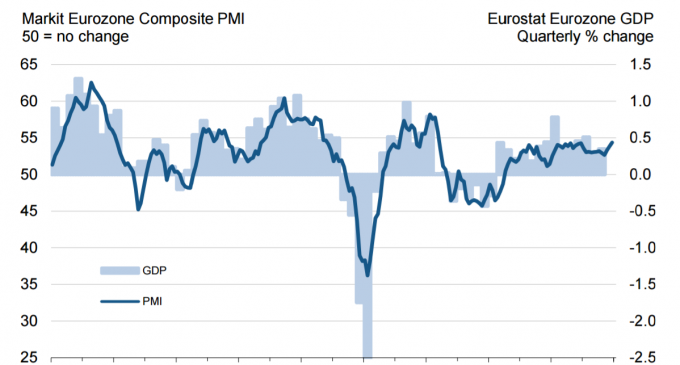

“The final PMI data signal an even stronger end to 2016 than the preliminary flash numbers, though whether this provides a much-needed springboard for the euro area’s recovery to gain further momentum in 2017 remains very uncertain,” Chris Williamson, Chief Business Economist at HIS Markit said. “Much depends on political events over the course of the next year. The survey data are signalling a 0.4% expansion of GDP in the fourth quarter, with growth accelerating in December as business activity rose at the fastest rate for over five-and-a-half years.

“Manufacturers and, to a lesser extent, service sector companies are benefitting from the weaker euro, which is both boosting goods exports and encouraging demand for services exports such as tourism and travel to the eurozone. Rising employment, and of course the ECB’s stimulus, are also playing roles in driving the expansion.

“The concern is that domestic demand is likely to remain subdued over the course of 2017 as political uncertainty dominates, resulting in another year of disappointing growth across the region as a whole. For the moment, however, companies are brushing off political worries, with optimism among service sector companies – who will arguably be the most affected by any political turmoil – reviving to one of the highest levels seen for over five years.”