An overview of the Agri-food Sector and the benefits of R&D tax credits and the Knowledge Development Box for Irish based companies

Ireland benefits from its green image and reputation for quality which is most important given the increased focus on traceability, food security, standards and quality production systems. With this in mind, brand recognition is vital to build consumer trust and confidence and international reputation 1. The Irish Agri-food sector is Ireland’s most important indigenous sector and has a turnover of €26 billion and an annual payroll of €1.7bn making it Ireland’s largest manufacturing sector 2. With five years of sustained growth, goods to the value of €10.5bn were exported to 120 countries in 2014 by the agri-food sector. Half of these exports were by indigenous Irish companies. The breakdown of the markets include 40% to UK, 31% to Europe and the remaining 29% to international markets. To emphasise the importance of this sector, €9.6bn worth of materials were purchased, whereby, 76% of these materials were sourced in Ireland3. Looking towards the wider economy, the sector uses 90% of the output of Ireland’s 120,000 farmers and purchases €7.9bn worth of goods and services every year. Direct expenditure by the food sector in the Irish economy is equivalent to almost 60% of sales. This compares with 19% for the rest of manufacturing. Therefore, every extra €100 of food output is putting €60 at minimum back into the Irish economy2.

Ireland benefits from its green image and reputation for quality which is most important given the increased focus on traceability, food security, standards and quality production systems. With this in mind, brand recognition is vital to build consumer trust and confidence and international reputation 1. The Irish Agri-food sector is Ireland’s most important indigenous sector and has a turnover of €26 billion and an annual payroll of €1.7bn making it Ireland’s largest manufacturing sector 2. With five years of sustained growth, goods to the value of €10.5bn were exported to 120 countries in 2014 by the agri-food sector. Half of these exports were by indigenous Irish companies. The breakdown of the markets include 40% to UK, 31% to Europe and the remaining 29% to international markets. To emphasise the importance of this sector, €9.6bn worth of materials were purchased, whereby, 76% of these materials were sourced in Ireland3. Looking towards the wider economy, the sector uses 90% of the output of Ireland’s 120,000 farmers and purchases €7.9bn worth of goods and services every year. Direct expenditure by the food sector in the Irish economy is equivalent to almost 60% of sales. This compares with 19% for the rest of manufacturing. Therefore, every extra €100 of food output is putting €60 at minimum back into the Irish economy2.

The Governments expansionary strategy for the sector [Food Wise 2025 (FW2025)] sets out to reinforce these linkages and to contribute to sustainable jobs growth in the wider economy. This strategy was launched in June 2015, with the following objectives4:

Increasing the value of agri-food exports by 85% to €19 billion.

Increasing the value added in the agri-food, fisheries and wood products sector by 70% to in excess of €13 billion.

Increasing the value of Primary Production by 65% to almost €10 billion.

The creation of an additional 23,000 direct jobs in the agri-food sector all along the supply chain from primary production to high value added product development.

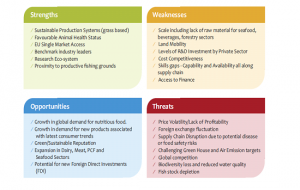

It is worth noting that these targets were set pre Brexit. However, looking at the SWOT analysis from FW2025, it clearly identifies the challenges and opportunities which must be addressed and supported, see Figure 1.

Figure 1 SWOT analysis of the Irish Agri-Food Sector4.

So where to next? With the doubling of the world’s middle class predicted to be in excess of 3.2bn by 2020, major Irish companies like Kerry Group, Glanbia and Greencore are already gearing up plant and personnel to meet this soaring expansion5. However, high business costs, low margins, market access challenges, skills shortages and a market failure in access to finance all threaten the competitiveness of the sector. The agri-food sector operates to tight margins in circumstances where the multiples have considerable purchasing power. In the first instance, it is important that companies continue to embrace both lean and sustainable principles across their entire business operations by investing in capital equipment and automation, ICTs (technology deepening) and re-skilling of their workforce 1. In addition, more companies need to build capabilities and to add value through the development and introduction of new products and services. Companies also need to build capabilities in international selling including developing an understanding of different cultures, market tastes and global supply networks 1. A very large proportion of these potential new consumers now live in geographically concentrated markets across the world from growing EU conurbations to the teeming city hubs of Asia5.

So why is this now even more relevant? Basically the sector now needs to look beyond Brexit and embrace new markets. Looking at one particular example, in 2015 a partnership was signed between Bord Bia and SF Best, one of China’s leading e-commerce platforms for imported food will see a concentrated online promotion and sale of premium Irish food and drink5,6. Online shopping for food is becoming an increasingly important part of Chinese consumers’ purchasing habits. Such that, in the first three months of 2015, the value of Chinese online shopping transactions exceeded €108bn, up 45% on the same period in 2013. According to a recent study by Netherlands based Rabobank and Wageningen University, online sales of food are expected to continue growing at a rate of 50% annually, to a value of €280 billion by 20256. Imported food is expected to account for some 13% of this total value. Ireland’s food and drinks exports to China increased in value by 50% in 2014 to reach €367m and exports to Hong Kong increased by 24% to €180m5,6.

To address the concerns of Brexit and to strive to meet the targets set out in FW2025 the Irish agri-food sector must build and hold a clear advantage over its competitors in the global marketplace. This will require investment in new technologies, research & development, quality management, plant infrastructure, education & training, brand development, process enhancement, lean manufacturing, capacity expansion and energy efficiency 2. Convergence is primarily enabled by advances in technologies, and results in the emergence of ‘new’ sectors and products such as nutraceuticals and combination products, areas in which Ireland has considerable opportunity based on existing sectoral strengths 1. However, looking at the SWOT analysis (Figure 1), the low levels of private R&D expenditure is a real concern.

Research, Development and Innovation (RDI) are key drivers of competiveness and central to maintaining competitiveness in the long term. However, as stated in FW2025, challenges faced by the sector in relation to RDI include gaps that exists (i) between translating research into commercial products and (ii) on the capacity within the sector, both at producer and company levels (in particular SMEs), to absorb new research and innovation. Economic theory provides a strong justification for government support for R&D, including subsidies and incentives for business research. Without such support, companies are likely to underinvest in research (from the standpoint of the economy as a whole) because the results of R&D cannot be fully appropriated by the investing firm 7.

So how can the government help address these concerns? One mechanism is R&D Tax incentives. The theory of optimal taxation requires that a form of tax be neutral on an individual’s or a company’s decisions, for example between one form of investment and another. Neutrality would therefore imply that a company should not be incentivised to invest in R&D over other investments. However given the externalities that exist in respect of private sector investment in R&D, R&D incentives are regarded by economists as one of a small number of examples of where policy makers should explicitly depart from neutrality 8.

R&D tax credit provides a provision for a tax credit for certain expenditure on R&D activities, plant and machinery and buildings. Salaries paid to employees who conduct qualified activities are generally the largest component of qualifying R&D expenses. The money paid to the staff performing the qualified R&D activities as well as project managers and personnel who directly support the R&D can qualify. The goal of the R&D tax credit is to encourage R&D investment by indigenous and foreign owned firms alike by rewarding qualified research. To help offset the R&D cost to companies and to promote innovation and competitiveness, the R&D tax credit and the recent Knowledge Development Box (KDB) are valuable tax resources which encourage companies to create new and improve existing products and processes and intellectual capital in Ireland. The incentive provides a 25% refundable tax credit on the qualifying R&D expenditure and in relation to the KDB, profits arising from patents, copyrighted software or IP equivalent to a patentable invention are taxed at 6.25% rather than the headline rate of 12.5%.

This tax mechanism offsets against tax liability because the credits can help companies increase their cash flow and earnings per share, reduce their effective tax rate, hire more staff, develop new products, and finance other business objectives 9. In Ireland, the cost of the scheme to the exchequer was €421 million in 2013 10 and almost 1,400 companies, employing nearly 150,000 people, have availed of the incentive 11, yet many agri-food companies aren’t aware of the credit.

Traditional research activities that take place during the development of advanced food science aren’t the only activities that qualify for the R&D tax credit. So, as long as companies are attempting to develop new and improved products, product lines, manufacturing processes, or software, they could be eligible. While companies are beginning to plan for the coming year and beyond, there is no time like the present for R&D and financial professionals within the sector to evaluate whether they’re taking full advantage of the R&D tax credit. From our experience there are 3 questions which are commonly asked;

How does the credit work? The R&D credit works by providing a company with a credit calculated as 25% of qualifying R&D expenditure. In addition to the 12.5% trading deduction, this effectively means that the company can benefit from an effective tax benefit of 37.5% on their R&D spend.

What are qualifying expenditures? This is expenditure incurred in developing processes which are systematic, investigative and experimental and as such qualify for the credit as set out by the guidelines issued by Revenue. Eligible expenditure includes direct and indirect costs so long as they are incurred in the carrying on of R&D in addition to capital expenditure on related plant and machinery. Basically, the company must be incurring expenditure on qualifying activities which are seeking to achieve a scientific or technological advancement through the resolution of a scientific or technological uncertainty in a 12 month accounting period.

Why would a company claim the credit? Primarily, the principle gain to a company claiming the R&D tax credit is cash. This credit should not be undervalued or understated as cash is vital to the sustained health of any business. However, value can also be received for the R&D tax credit in a number of different ways, such as;

Including offsetting the tax credit against Corporation Tax,

As a refund by reference to payroll taxes and/or

Corporation Tax paid or as a reward to key staff in a tax efficient manner.

The natural follow on from the R&D tax credit is the Knowledge Development Box (KDB), which was introduced by Finance Act 2015 for companies whose accounting period commences on or after 1st of January 2016. As previously outlined the KDB, it is a regime for the taxation of income which arises from patents, copyrighted software and, in relation to smaller companies, other intellectual property (IP) that is similar to an invention which could be patented. The official guidelines for this scheme was issued by Revenue in August 2016.

In summary, choosing your R&D and KDB advisors is an important decision for you. It is essential that your advisors have the skills and experience required to deal and grow with the financial and technical needs of your business. It is equally important to know that your dedicated advisors will be able to form and maintain an excellent working relationship with your team and conduct their work in a professional and flexible manor. Within Mazars, we have a proven track record with the key credentials to provide a first-class detailed and tailored service that will go beyond our client’s expectations. It is this commitment which has our clients returning year on year. We have a specific dedicated Research & Development Tax Group which focuses on assisting companies in identifying activities that qualify for the KDB and Research & Development Tax Credit. In addition, we have the significant in house scientific experience to assist and advice in both the claim and technology. Our service also extends to support our clients in the event of an audit. For more information please contact Dr James Kennedy at jkennedy@mazars.ie

Authors

Dr. James Kennedy, Manager – Research & Development Tax Credit Group, Mazars

James O’Hagan, Tax Consultant- Tax Credit Group, Mazars

Gerry Vahey, Partner- Tax Credit Group, Mazars

References

https://www.djei.ie/en/Publications/Publication-files/Forf%C3%A1s/Making-it-in-Ireland-Manufacturing-2020.pdf [Accessed 10th of August 2016].

http://www.fdii.ie/Sectors/FDII/FDII.nsf/vPages/Publications~fdii-budget-2016-submission/$file/FDII%20Budget%202016%20Submission%20-%20Final.pdf [Accessed 10th of August 2016].

http://www.fdii.ie/Sectors/FDII/FDII.nsf/vPages/Food_Industry_in_Ireland~sector-profile?OpenDocument [Accessed 10th of August 2016].

https://www.agriculture.gov.ie/foodwise2025/ [Accessed 10th of August 2016].

Growing potential of the food industry in Ireland- John Daly, Irish Examiner January 2016 http://www.irishexaminer.com/business/growing-potential-of-the-food-industry-in-ireland-374226.html [Accessed 10th of August 2016].

http://www.bordbia.ie/corporate/press/2015/pages/ChinaSFBest.aspx [Accessed 26/07/2016].

The Corporate R&D Tax Credit and U.S. Innovation and Competitiveness Gauging the Economic and Fiscal Effectiveness of the Credit- Laura Tyson and Greg Linden (2012).

http://budget.gov.ie/Budgets/2014/Documents/Department%20of%20Finance%20Review%20of%20R&D%20Tax%20Credit%202013.pdf [Accessed 26/07/2016].

http://www.pharmexec.com/refuting-rd-tax-credit-myths [Accessed 26/07/2016].

https://www.kildarestreet.com/wrans/?id=2016-01-28a.276 [Accessed 27/07/2016].

http://www.irishtimes.com/business/just-15-firms-to-benefit-from-bulk-of-50m-tax-break-1.2084764 [Accessed 26/07/2016]