Continued Rise in Construction Activity as New Order Growth Quickens to Seven-month High

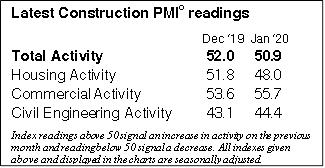

The Ulster Bank Construction Purchasing Managers’ Index® (PMI®) – a seasonally adjusted index designed to track changes in total construction activity – posted 50.9 in January, above the 50.0 no-change mark for the second successive month to signal a rise in activity in the Irish construction sector. That said, the reading was down from 52.0 in December, pointing to a softer expansion.

Commenting on the survey, Simon Barry, Chief Economist Republic of Ireland at Ulster Bank, noted that: “The latest results of the Ulster Bank Construction PMI survey show a second consecutive monthly rise in Irish construction activity in January as the sector kicked off 2020 in expansion mode, albeit at a slower pace compared to December. Respondents reported particular strength in Commercial activity where a third successive monthly increase saw its index pick up to an 11-month high. This leaves growth in commercial projects running at a very solid pace above the long-run average for the survey which spans the past 20 years. In contrast, the January results on residential activity were on the disappointing side. Following a bounce in December, the Housing PMI dipped back below 50 last month as respondents reported an early-year contraction in residential activity. However, with leading indicators such as the housing commencements data continuing to point to further upside for housing output, we would be surprised if the Housing PMI doesn’t show some improvement in the months ahead.

“Indeed, the forward-looking elements of the PMI survey itself are painting a more positive picture of the sector’s prospects following a notable soft patch which took hold over the second half of last year. In particular, a second consecutive strong improvement in the New Orders index took the growth rate of new business to a 7-month high in January as reduced Brexit-related uncertainty was again cited as a support for the near-term outlook. Furthermore, there was also a further strengthening of optimism about the year ahead where sentiment rose to its highest level in 12 months. Over 43% of respondents expect their activity to rise in 2020, with firms citing strong pipelines of new work as a key support for the outlook for the coming year.”

“Indeed, the forward-looking elements of the PMI survey itself are painting a more positive picture of the sector’s prospects following a notable soft patch which took hold over the second half of last year. In particular, a second consecutive strong improvement in the New Orders index took the growth rate of new business to a 7-month high in January as reduced Brexit-related uncertainty was again cited as a support for the near-term outlook. Furthermore, there was also a further strengthening of optimism about the year ahead where sentiment rose to its highest level in 12 months. Over 43% of respondents expect their activity to rise in 2020, with firms citing strong pipelines of new work as a key support for the outlook for the coming year.”

Marked rise in commercial activity

Underlying data suggested that the overall rise in activity was centred on a strong performance in the commercial category. Activity on commercial projects increased markedly, and at the fastest pace since February 2019. Elsewhere, a modest reduction in housing activity was recorded, while civil engineering activity decreased at the slowest pace in eight months.

Fastest rise in new work since last June

Improving market conditions and greater certainty surrounding Brexit helped lead to a marked increase in new orders during January. New business rose for the second month running, and to the greatest extent since June last year.

Further improvement in business sentiment

Business expectations data suggested that firms generally foresee activity continuing to rise over the course of 2020. Sentiment rose to a 12-month high at the start of the year, with more than 43% of panellists predicting a rise. Respondents often highlighted a good pipeline of new work.

Rising new order volumes led constructors to expand their staffing levels again in January, extending the current sequence of job creation to just shy of six-and-a-half years. Moreover, the latest rise in employment was solid and the sharpest for seven months.

Input buying also increased at a solid pace, rising for the second consecutive month at the start of the year.

Irish construction firms posted a further rise in input costs, with higher prices for raw materials such as cement, glass and steel mentioned by panellists. There were also some reports of higher charges from UK-based suppliers. That said, the overall rate of inflation softened to a four-month low.

Finally, suppliers’ delivery times lengthened solidly again at the start of the year. The rate of deterioration in vendor performance was broadly in line with those recorded through the final quarter of 2019.