Strategic Banking Corporation of Ireland makes €50m available to SMEs

The Strategic Banking Corporation of Ireland (SBCI) is to make lending of €50m available to small and medium-sized businesses looking to buy equipment, machinery and vehicles.

The Strategic Banking Corporation of Ireland (SBCI) is to make lending of €50m available to small and medium-sized businesses looking to buy equipment, machinery and vehicles.

The money will be provided through Finance Ireland and will include leasing, hire purchase and rental agreement options.

There is no upper or lower limit on the loans and Finance Ireland will make them available at a 1.9% discount to current rates, which are understood to average about 8%.

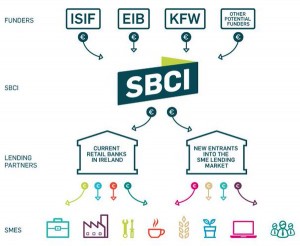

SBCI is Ireland’s state development bank, which includes backing from German promotional bank KfW.

It has committed to providing at least €800m worth of loans to SMEs here and has already pledged €400m to a programme which sees AIB and Bank of Ireland provide both lower interest, long-term loans to businesses.

Over 1,600 Irish SMEs benefited from SBCI loans in its first four months in operation. They borrowed €45m in total through AIB and Bank of Ireland.

“The SBCI is here to help solve problems in the SME lending market and help SMEs to support jobs and grow their businesses”, the lender’s chief executive Nick Ashmore said.

He said the SBCI is bringing its first non-bank finance provider on-board which will help drive competition in Irish SME lending.

“Our first phase of new SME loans, launched earlier this year through AIB and Bank of Ireland, has been a real success in addressing the needs of SMEs. We are confident that our second phase, starting today, will be equally successful,” he added.